extended auto repair insurance: a cautious look before you buy

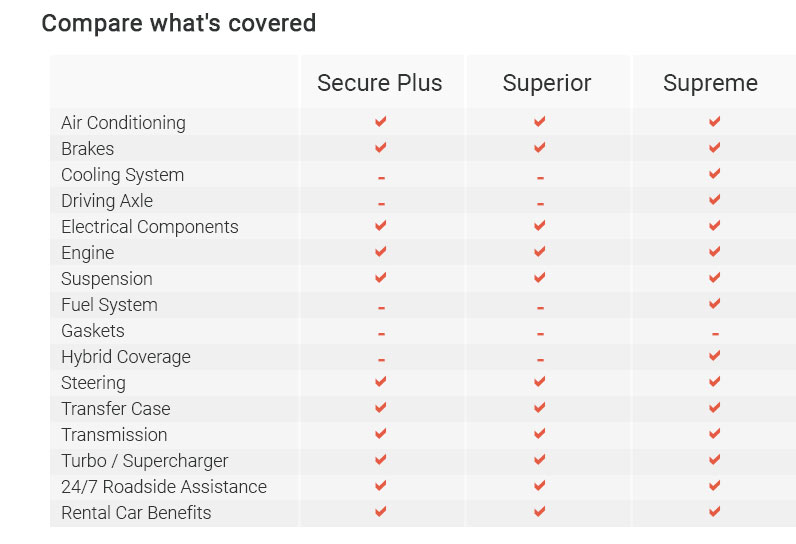

What it really covers

I like warranties in theory, but I read the fine print twice. This coverage promises help when a major component fails after the factory warranty ends. The promise matters; the details matter more.

- Powertrain often included; accessories are hit-or-miss.

- Wear items like brakes and tires? Usually excluded.

- Diagnostics and taxes can be covered, capped, or ignored.

- Deductibles may apply per visit or per repair.

Where it helps, and where it doesn't

On a wet Thursday, my neighbor's starter died two months past warranty. One call, a tow, claim approved, and a rental for two days. Deductible paid, bill mostly covered. Good outcome - yet the policy had already cost months of premiums, and it wouldn't have helped if the battery had been the culprit.

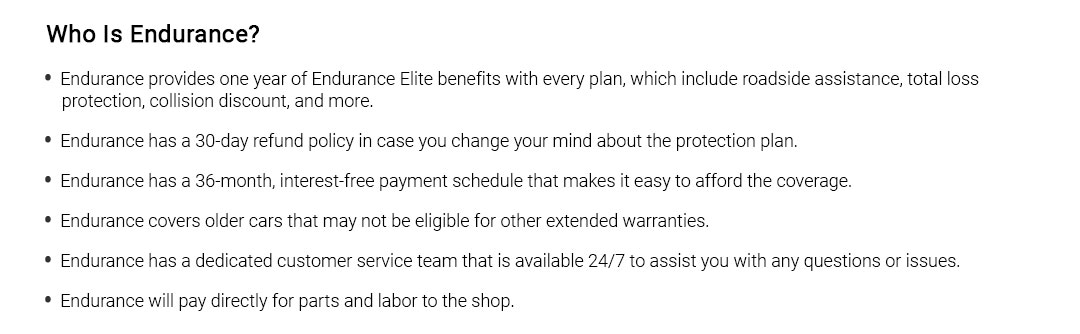

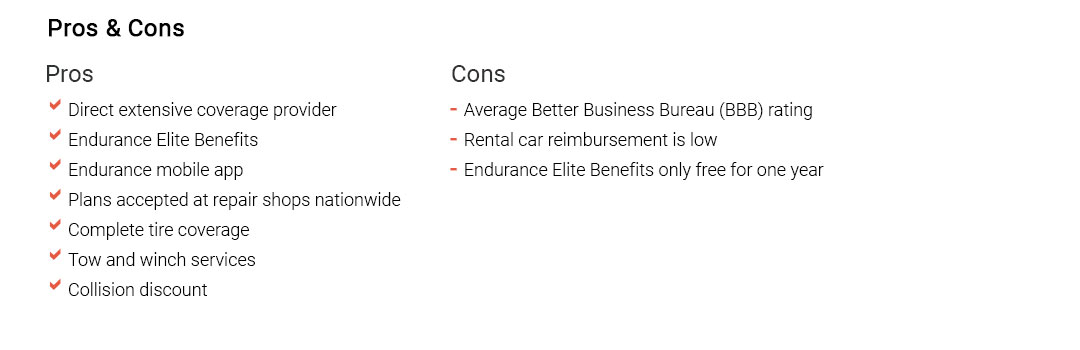

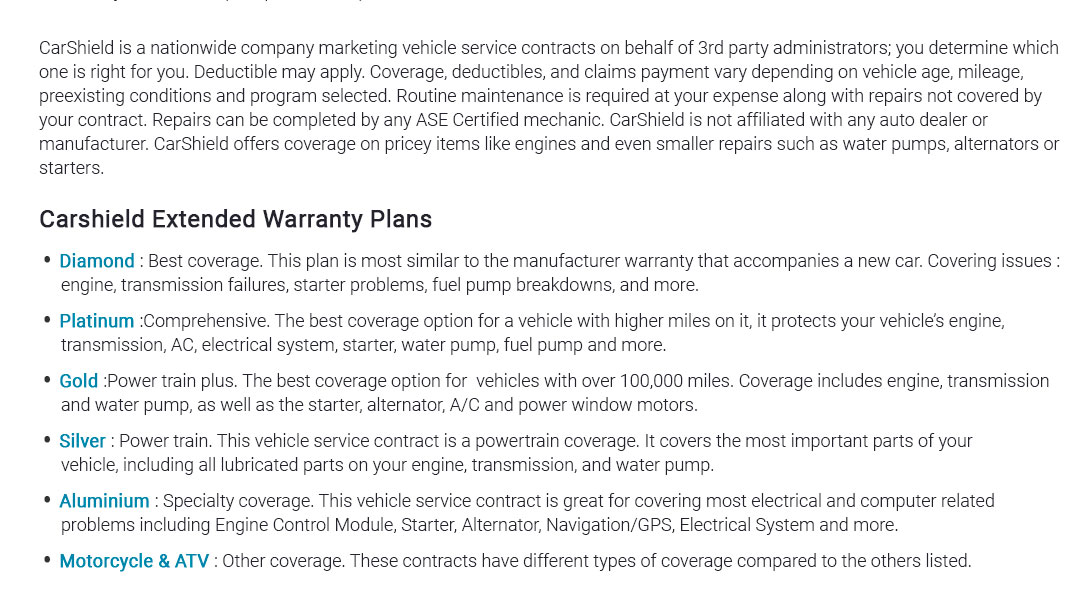

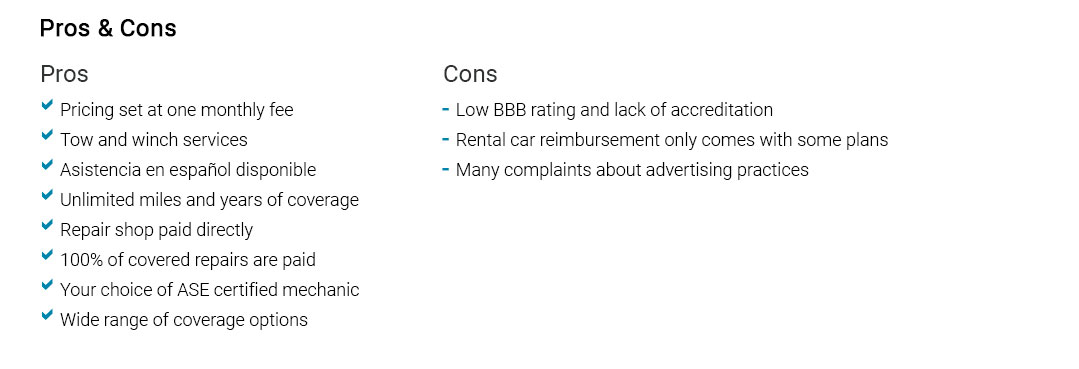

Compare before you sign

- Match coverage to common failures for your model and mileage.

- Check labor rates, parts quality, and whether you choose the shop.

- Look for limits, per-claim caps, and aggregate maximums.

- Ask how pre-authorization works and typical claim timelines.

- Verify transferability and cancellation refunds.

Tempered expectation: this isn't a money printer. For reliable cars with low annual miles, a repair fund may beat premiums. For complex, high-mileage vehicles far from warranty, coverage can buy predictability more than savings. I want reliability first, insurance second - and only after a careful comparison of cost versus risk.